Fun Stuff We Think About to Avoid the Painful Stuff We Don’t Want to Think About

On Inheritance, the Lottery, and Winning in Vegas

It is human nature to avoid thinking about unpleasant things. So, it would be natural to avoid the unpleasant reality that SAVING FOR RETIREMENT is WORK.

And as humans, we sometimes look for the path of least resistance. When it comes to having enough for retirement, this could lead us to follow some paths we perceive as easier. I’m looking at you lotteries, Las Vegas, and inheritances.

Let’s take an honest look to see if any of these “easier to implement” areas would lead to greater retirement success compared to the boring, long-slog approach of “saving steadily year after year.”

Oh, To Be a Rockefeller

To start with, the “hey, I’ll just hope for an inheritance” solution to retirement planning is out there calling us. Certainly, lots of people in the U.S. are catching a break thanks to parents or grandparents who have left them something, right?

Actually, that’s wrong . . .

POP QUIZ: What percentage of Americans gain an inheritance?

a. 10% b. 30% c. 55% d. 78%

The answer is B. Less than a third of all households inherit any money, which means between 70% and 80% of households receive no inheritance at all.*

But wait, there is more. Thirty percent isn’t nothing, you might say. What if I’m one of the thirty percenters who gets something upon the death of someone else?

Regarding those who DO receive an inheritance:

POP QUIZ #2: What is the average inheritance in the U.S. that a grandchild receives from a grandparent?

a. $1,458 b. $5,698 c. $25,555 d. $106,000

The answer is A. Data shows that the average inheritance received from a grandparent was $1,458.**

Certainly, a thoughtful gesture on the part of gramps and grammy, but not enough to hang your bowler hat on. Here is a graphic that shows the data on inheritances in the U.S.

Only one out of a hundred inheritances comes close to being “big.” The average inheritance in the U.S. is nowhere near the $1.5 million generally needed at retirement for the typical household to cover a thirty-year retirement. **

As you can see from the chart above, there are very few among us who can rely on an inheritance to fund our retirement. Ninety-nine out of a hundred will have to come up with a more sensible plan.

“Let it Ride”

Ok, so how about a nice trip to Las Vegas? Surely many folks make out like bandits and score a huge chunk of change from gambling at the casinos, maybe even enough to get them through retirement. Let’s take a look. Overall, how successful are gamblers in Las Vegas?

POP QUIZ: What percentage of gamblers in Las Vegas end up winning money?

a. 13.5% b. 25.1% c. 46.9% d.68.3%

The correct answer is A. About 13.5% of gamblers go home from a casino having made any money.*** This statistic comes from a study of 4,222 gamblers, and only seven of them won more than $150. Conversely, 217 of them lost over $5,000 at casino games. Also, note that those who play more often have lower chances of winning.

POP QUIZ #2: How much does the average gambler lose in Las Vegas?

a. $50 b. $500 c.$5,000 d.$50,000

If you guessed B, you should gamble more. (-; According to the Nevada Gaming Control Board, the average gambler in Las Vegas loses around $500 per trip, excluding free rooms. The group found that the average gambler wagered $717 in 2021 and lost $506. It’s fair to say these stats are a few years old. And sure, these are gross averages, and your mileage may vary. But its also fair to say that as a strategy to bet your retirement on, gambling in Las Vegas may not be the answer.

But Wait, What About the Lottery?

The chances of winning Mega Millions and the Powerball are 1 in 300 billion. Enough said. By definition, only one person wins. By definition, these drawings happen once a week (or maybe twice, but you get the idea). So 52 (or 104) winners a year for each “big lottery” (though not always, due to rollovers from week to week). Add in the state lotteries, and you have a few thousand people every year winning big. There are 346 million people in the U.S. The number of winners is just too small. We almost don’t have to talk about the dollar amounts they win. The whole point of a lottery is a bunch of people put in money so one person can win big. When all is said and done and the Powerball number is drawn, we still need a retirement solution for the big bunch of people who lost.

Just a Stranger on the Bus, Trying to Make My Way Home . . .

We can’t blame ourselves for wanting things to turn out well. Human beings can often be positive thinkers at heart. It is very common for us to think that something is going to come up to rescue us from our current problem or dilemma. Researchers call this “optimism bias.” We dream of hitting the “big one,” whether it be the lottery, or the big casino jackpot, or an unexpected windfall from a relative who passes away. Optimism bias is the tendency to overestimate the likelihood of positive outcomes and underestimate the likelihood of negative outcomes happening to ourselves, leading to a belief that we are less likely to experience negative events compared to others. It would push us to believe that others may lose in Vegas, or lose the lottery, but certainly WE could be among the winners, right? Statistics just don’t back this up.

So don’t beat yourself up about dreaming about this stuff. Just be aware that it is “a thing” to think that we will somehow not have to do the obvious, hard, boring thing sitting right in front of us. Everyone does it.

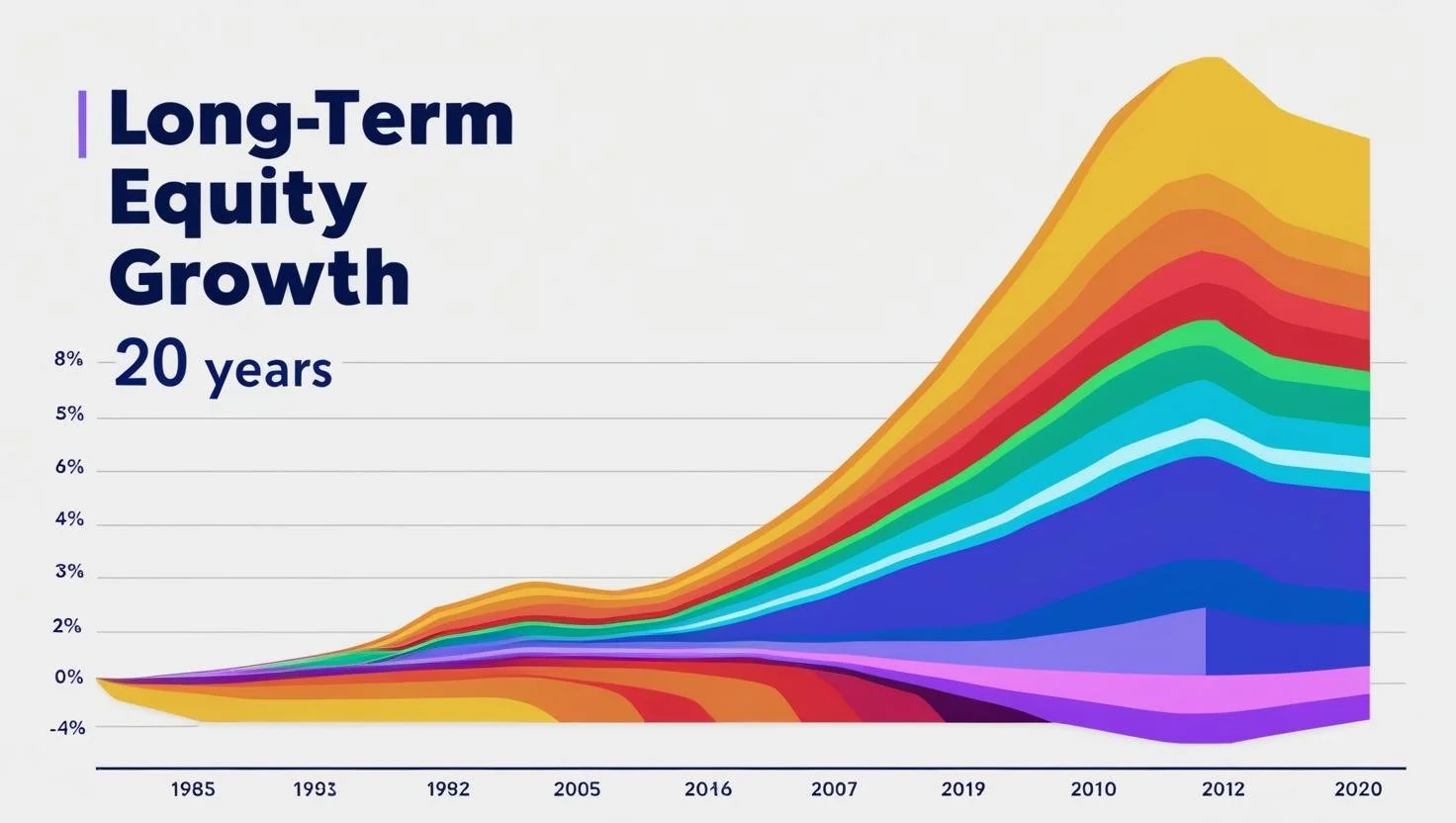

There Is Some Good News

You know what else is really super common? It’s common for the stock market to gain over the long term. The longer the time frame, the greater the chances of a positive outcome. For example, over the past century, about 94% of the 10-year periods have been positive. (So from, say, 1935 to 1944, the “stock market” showed positive gains for that period. From 1976 to 1985, positive gains for that period, etc.) A huge percentage of these ten-year periods showed positive results.

So unlike gambling in Vegas, or spending money on the lottery, the stock market generally gains money so long as we are talking about a long-term time period. People talk about a risky stock market. And it can be over shorter periods of time. But with a diversified portfolio, it is way more common NOT to lose money over a ten-year period compared to other ventures. And when you bring in 15- and 20-year periods, the statistics grow even more favorable.

So, as we pivot back to retirement planning, here are three ideas to consider:

-Think long term. The market grows over the long term, and your retirement planning will happen over a long time horizon.

-Start saving now. The sooner you tap into that growth, the better for you.

-Have some fun and play the lottery for a couple of dollars every so often. Just start doing it after you are on the path to saving 15% of your annual income for retirement. Everyone has heard that Steve Jobs played the lottery and picked the numbers 1-2-3-4-5-6. Pick different ones but use the same ones every time you play.

-Give yourself a dopamine hit every once in a while by checking your total retirement account balances to see how much they grew while you were away living your life. (Do not check your balances too often. It will drive you crazy because, on a day-to-day basis, things fluctuate—a lot.)

Why not hope for the best, BUT PLAN FOR THE WORST? (Or in this case, plan for the typical. No shame in not winning the lottery. No shame in not beating the house in Vegas. No shame that you were not born a Rockefeller. Let’s get on with the show!)

Long-term investing could offer way better odds than Las Vegas or the lottery. Sorry it’s so boring. But you know what? A little dopamine hit every time you see your balance go up can be fun.

Next Up:

My Money Story

* Federal Reserve data. Mar 23, 2024

** University of Pennsylvania used data collected from the Survey of Consumer Finances 2021

*** June 2019 Las Vegas Convention and Visitors Authority.

**** Nov 8, 2023 “How much money does the average gambler lose in Las Vegas each trip ...” quora.com