What if You Were to Save the Equivalent of One Year of Income?

In the last post we talked about what percentage of income to save to enjoy a comfortable retirement. [link]

As you work to save at least 12-15% of your income, let’s talk about a way to track your progress.

One nice goal to set, and a great way to track progress, is to aim for saving the equivalent of one year’s worth of income.

It’s a mental exercise many have found helpful to guide their saving journey. So think of your annual income, including everything like bonuses and investment income, and set that as your dollar figure to save. It may be a challenge, and it may take some time, but by doing the things you need to do to save the equivalent of one year of income, you will set yourself up for the future. You will need to think about your spending (more on that coming), and work to carve out enough to save. You may need to really crack down on that credit card debt. You may choose to bump up your savings rate, or open your own retirement account outside of your employer. If you can work your way through these steps (we will help with all of them here), you will have laid your entire retirement foundation.

So here is a suggested first milestone:

Save the Equivalent of One Year’s Worth of Income

If you can get that first year of income saved, it’s a huge accomplishment. It’s a good goal to set this as Milestone #1 when it comes to saving.

How Long Will It Take?

It may take some time to accumulate a year’s worth of income. How much time? Well, that all depends on . . . your savings rate. Sound familiar? These things go together like peanut butter and jelly. Like Lois and Clark. Like ... never mind.

Using your 15% savings rate, it will take, given an 8% annual investment return,

between five and six years to save the equivalent of one year of income

Don’t get discouraged. If you can hang in there, what happens is you reach an “inflection point” where your savings actually starts to grow at an accelerated pace. We will talk about that next. So this early phase is the hardest, but the “one year of income” goal is actually a super weighty concept that can really get you moving in the right direction.

Let’s get specific for your situation. Use this interactive calculator to estimate how long it will take you to save that first year of income: Years Needed.xlsx

Note that we are ignoring inflation for now. And forget also the “time value of money.” This “one year of income” concept is a mental exercise. We are keeping it simple. When using the calculator above:

-Recall your savings rate

-Use the 8% assumed investment rate of return, or choose your own

-View the table to understand how long Milestone #1 will take.

Hopefully it will become clear that getting that first year of income saved is heavily driven by your savings rate, with a little help from your investment rate of return.

Note: Is it realistic to ignore inflation and the time value of money? As a way to set a milestone and keep mental track of your progress, the answer is yes, it’s OK to ignore the time value of money and just track “equivalent years of saving.” This is a thought experiment, so there is much benefit in thinking of it this way. Just save one year of income, and assume, for now, that amount will cover your spending in the first year of retirement.

Teleport to Year One of Retirement

Here is another way to track your progress. See if it resonates with you. If not, no worries. There are more ideas to come.

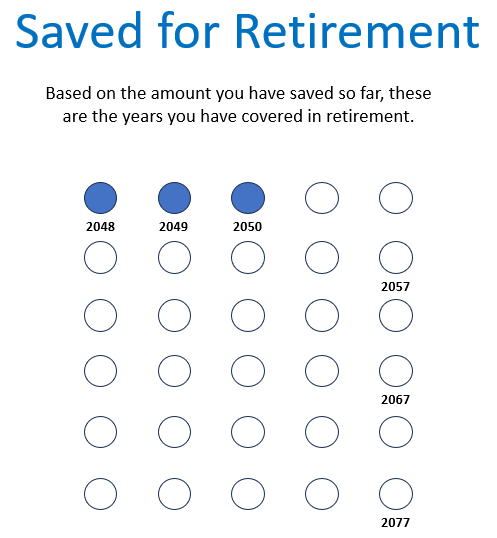

Try this: Consider tagging this “one year of annual income” to a specific year in retirement. So, save a year of income now, and earmark it for a specific year in the future when you are retired. For example, a 40 year old wanting to retire in 24 years will hit their first year of retirement in 2048. So, save for 2048. And then save for 2049, and so on. If you were to write it out in a chart or graph, it might look like this:

Here is what it looks like for that 40 year old, wanting to retire in 2048, and having made some progress on a retirement savings account, say a 401k or an IRA. In this illustration, their retirement account balance is large enough to cover three years of retirement spending.

If you can visualize your first year of retirement, it can help make your plan more concrete.

So when is your first year of retirement? Use this quick calculator to find out which year you will be saving for.

Just think of [fill in your first year of retirement] as a bucket that needs to be filled with enough to cover your spending in that first year of relaxation bliss.

So the way to proceed is this:

-Visualize your first year of retirement

-Assume your spending in that first year will be the same as your spending now

-Start saving for that year

As you continue to save additional years of income, tag each year of savings for a specific year in retirement.

So what have we learned?

-First, a good starting goal is to think about saving ONE YEAR’s worth of annual income.

-It will take a little time, a bit more than five years given a savings rate of 15% and typical investment returns. But it will be worth it, because the money you save now could be worth MUCH MORE in the future.

-Second, track your progress by specifically identifying the years you will be in retirement, and saving for them one by one. It’s a great way to visualize your future retirement state.

You can do it!

Next Up: Great news. We will show you that your first year of savings today could cover many years of spending when you retire. Let’s get re-acquainted with a powerful concept that will accelerate your retirement progress.

Friendly request: This whole blog is an endeavor aimed at helping folks improve their retirement situation. My goal is to post content that folks like you find useful in planning their retirement. Please comment below with feedback and think along the lines of “Was this helpful? What else would you like to know? Any burning topics or steps related to retirement planning on your mind right now?” Thanks!