The Three Key Factors in Investing for Retirement (Part 2) — Fund Quality

Choose High Quality Funds

What do we mean by a “quality fund?” Quality refers to how well a fund is managed compared to its objective, and to its peers.

It is hard to sort through “quality” on your own. Luckily, there are firms out there in the world who rank funds for a living. Ratings coming from an independent firm, like Morningstar’s one-star (worst) to five-star (best) method, allow you to quickly understand whether a fund is a quality fund.

One thing to keep in mind is that ratings are all relative, meaning funds are all compared to their peers. Rating companies will group similar funds together, usually by asset class, and then rate and rank them as a group, sorting them into the high performers and the low performers.

Quality Funds Help You Over the Long Term

There have been a few studies on how important it is to pick a four- or five- star fund. While these funds can occasionally drop back to the “average” range after three to five years, a good number of these funds do manage to stay at the top, meaning at least three stars or above. A much smaller number drop to the one-star and two-star level.

So maybe a good strategy here is to just keep it simple and avoid or eliminate one- and two-star funds, and keep it at that.

Consider a “quality” fund to be one in the three-star, four-star, or five-star range.

How Much of a Difference Does Quality Make?

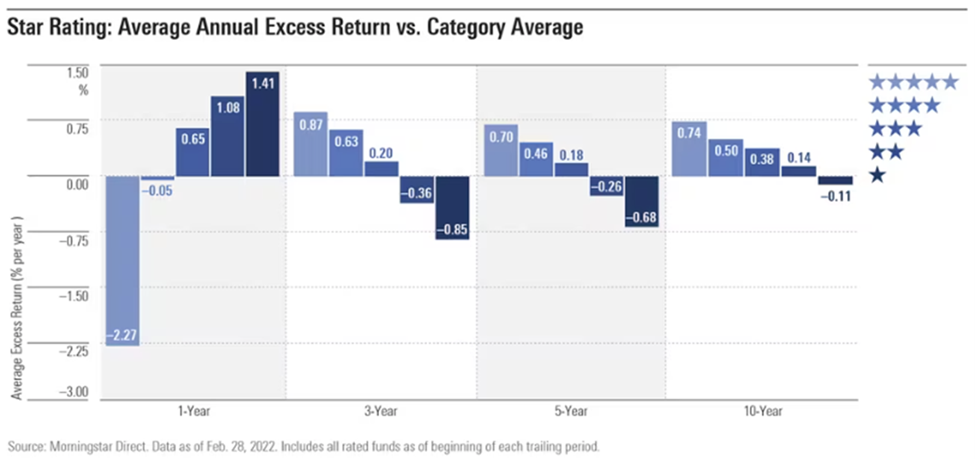

Let’s put a number on this. If we take a popular group of funds, the large cap blend category, and sort their performance based on star rating, which represents our measure of quality, here is what we see.

Focus on the 3-year and 5-year and 10-year columns. This chart shows that five-star funds (light blue) consistently perform better than average each year. One-star funds (darkest blue) consistently perform worse than average each year.

In the chart above, the 5-year column (second from right) shows that five-star funds (light blue) consistently perform 0.70% better than average each year. One-star funds (darkest blue) consistently perform 0.68% worse than average each year. Add these two numbers together and you get a 1.38% bump in investment return each year from a five-star fund compared to a one-star fund. That is a huge difference.

Note that we are looking at just one category above, the large cap blend category. Ranges are different for different asset classes, but the overall trend will be the same: over a five- or ten-year period, the higher quality funds will outperform the lower quality funds.

So What Have We Learned?

There is a huge premium for choosing high quality funds. The range of 1.38% in performance illustrated above could mean over 23% more in retirement savings over a thirty-year period. Use this widget to figure out how much it will impact your retirement success to pick high-quality funds: Four Factors Demo.xlsx

Next Up: Find the right mix of funds. We will show you why diversifying your investments makes a difference, and how to pick a good mix of funds.

Friendly request: This whole blog is an endeavor aimed at helping folks improve their retirement situation. My goal is to post content that folks like you find useful in planning their retirement. Please comment below with feedback and think along the lines of “Was this helpful? What else would you like to know? Any burning topics or steps related to retirement planning on your mind right now?” Thanks!