The Three Key Factors in Investing for Retirement (Part 3) — Finding the Right Mix

Chose Funds That Mix Together Well as a Portfolio

Your retirement savings will grow much faster if you invest the funds rather than leave them sitting as cash in something like a bank savings account. And when you do invest, one of the key concepts to follow is diversification.

What is Diversification

Mutual funds come in a variety of flavors. Think of diversification as putting together a well-balanced plate of food for dinner. A well-balanced meal includes some protein, carbs, healthy oils and fats, legumes, etc., and sure, something sweet for dessert.

A well-balanced portfolio also means variety. To build a proper portfolio, include funds from a variety of different categories. Mutual funds fall into groups just like food, though there are A LOT more fund styles than there are food groups. One of the most common categories is “large cap,” meaning companies with lots of revenues, global operations, and lots of employees. These companies can be stable, steady performers, and so are part of the foundation when building a portfolio. The “small cap” category refers to companies often earlier in their life span, with quicker growth, but also a shorter track record, and so this category can be more volatile, with higher highs but lower lows when it comes to performance. You can also fill your plate with an international fund, something from the emerging markets category, and a corporate bond fund. Other fund styles include those that focus exclusively on tech stocks, or financial services, or commodities. It can get a bit ridiculous, but we will keep it simple here.

Why Diversify?

Just like the way food groups impact your nutrition and health differently, funds behave differently in certain economic cycles. You need a variety of different funds because in any given economy, some of them will do well, and others won’t. And the way the math works (we won’t get into the algebra), if you mix the funds together well, your overall portfolio will be less risky (volatile) from year to year compared to holding funds all from one category. Individual categories swing up and down more erratically.

The key is the funds need to come from different categories, also known as “asset classes.” If you mix together funds from different categories, the overall volatility of your portfolio smooths out. You are less likely to have funds that lose value at the same time, and the overall portfolio with grow at a smoother rate.

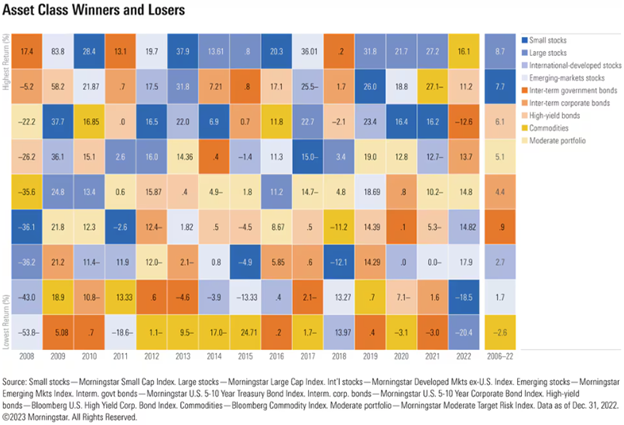

The chart attached shows the performance of different asset classes over time.

This is a ranking of mutual fund categories. Each category is given a different color. Each column is a different calendar year. All you have to do is notice how the colors jump up and down each year. Notice how many times an asset class finishes at the top of the list, and then the next year falls toward the bottom of the list. The dark blue category (small cap stocks) is a good example.

Notice that things are cyclical. A fund category often does well one year and poorly the next. Or, it may string together a couple of good years, then drop after that. The key is, NO FUND category stays on top forever, so the key is to mix up your asset classes.

So don’t put all of your holdings in just one box, or you will get wild swings in performance. Mixing together a whole plate full of funds into a portfolio will give you much steadier returns, allowing you to sleep better at night.

The Basic Diversified Portfolio

Let's keep it simple. The most basic asset allocation includes equity investments and fixed income investments. That is generally considered the starting place. This offers a base level of diversification, targeted to someone with thirty years to go until retirement, and with an average appetite for volatility in the markets:

Level 1

U.S. Equity Fund. 80% of total. You need a “total market fund” that gives you exposure to the entire domestic equity market including small-, mid-, and large-cap growth and value stocks.

Total Bond Fund. 20% of total. Choose a fund that covers a broad variety of U.S. bonds, including investment-grade bonds, U.S. Treasuries, and mortgage-backed securities of all maturities (short-, intermediate-, and long-term issues). One popular fund in this category invests about 30% in corporate bonds and 70% in U.S. government bonds.

Level 2

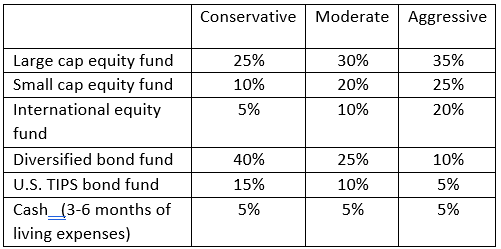

You could get more detailed with the categories you invest in, if you desire. You could further diversify by spreading your equity exposure among several categories we talked about above. This might include large cap, small cap, and an international equity fund. For fixed income, you could add in a treasury inflation-protected bond fund.

Level 3

We will not get into more advanced asset allocation topics here. A good source for allocations is the Morningstar Lifetime Allocation Chart here.

What We Have Covered

As we saw above, in any given year one investment style tops all the others in performance. But we can also see from the chart that this top performance rarely lasts. In a following year, the same top performer could end up in last place. So, to achieve steady performance on your portfolio overall, be sure to hold a balanced lineup of funds that cover several different styles or categories. Start with a Level 1 80% / 20% allocation to equity and fixed income, respectively. If you choose to get more detailed with Level 2, use the asset class color chart to familiarize yourself with the different asset classes, and then use the table above as a rough starting point for amounts to allocate to each category. More detailed Level 3 allocations can be found using the Morningstar Lifetime Allocation guidelines here.