Why It Makes Sense to Automate Your Savings

One proven way to kickstart your retirement savings is to automate your contributions. This refers to setting up a way for monthly retirement contributions to move into your accounts without any manual effort by you.

Research shows that those who automate their contributions are WAY better off than those who don’t. One study* shows this:

Investors who automate their contributions are

fifteen times more likely to save for retirement.

Not sure about you, but to me that looks like a huge factor to consider. Fifteen times more likely is a lot.

Note that with a workplace plan like a 401(k), the retirement contributions are handled by the employer, with little effort on the part of the employee. The funds are coming straight out of the employee’s paycheck and going directly into the investment account. The employee does not even see it happen. So, it’s a frictionless process with fewer chances for the contribution to get sidetracked.

Here are some benefits of automating your retirement contributions:

-Saves time each month by eliminating the need for manual effort to make the contribution

-Makes the saving process effortless (after the initial sign up) with monthly contributions that are “out of sight, out of mind.”

-Avoids missed contributions due to human factors like an overdraft or a spontaneous desire to spend the money on something else.

-You get to experience the WOW! factor when you check your account balance. Every so often you will get a nice surprise when you see how much your account is growing with very little effort on your part.

-If the contributions are part of a workplace retirement plan, they are tax deductible, so you are cutting your tax bill in the current year.

The reality is that manual, unscheduled contributions each month are hard to do consistently. It is difficult to overcome inertia, so why not just “set it and forget it?”

The key when doing this on your own is to start with a transfer amount that you are comfortable with, a contribution amount that does not radically change your monthly cash flow situation.

Take a look at these stats and we will chat about them below:

POP QUIZ #1:

What percentage of workers participate in a workplace retirement plan?

a. 5% b. 15% c. 38% d. 56%

The answer is D, 56%.**

Now, let’s immediately compare that to retirement plans that need to be set up manually by the individual, without help from the employer.

POP QUIZ #2:

What percentage of eligible Americans contribute to an IRA each year?

a. 5% b. 15% c. 38% d. 56%

The answer is B, 15%.***

So, we see a significant difference between contributions made to 401k plans and those made to IRAs. I will go out on a limb (not too far, I don’t think) and state that one of the primary reasons that so few people contribute to an IRA is that 1) there are more obstacles to setting up the account, and 2) they do not have their contributions automated. Perhaps they are not aware they can contribute to an IRA. (Note that anyone with earned income during a year can contribute to an IRA). Maybe they are not aware they can set up automated transfers on their own. Maybe there are just too many obstacles to setting up the transfer.

Regardless of the reason, it is WAY MORE likely a person will build retirement assets when they automatically transfer contributions on a regular basis. Going through the upfront work to set up a retirement account and set up automatic contributions (often this is the same process) could put you on the path to retirement savings.

Can you commit to automating your savings?

If you have a 401k, congrats! It’s already automated! (Maybe think about bumping up that savings rate. See the discussion here.) If you don’t have a plan through work, you can set one up on your own. What follows is some info on setting up accounts.

How to Do It

Would you like to automate your retirement contributions?

If you have a plan at work, then sign up via your human resources or benefits department. Your company will take care of deducting contributions from your paycheck.

If you don’t have a plan at work, transfer funds from your checking account or savings account. All banks allow this. You need to set up the IRA account to receive the funds. You will need your checking account number and your bank routing number (found online or at the bottom of a check, if you have an old-school checkbook).

Which Type of Account to Set Up

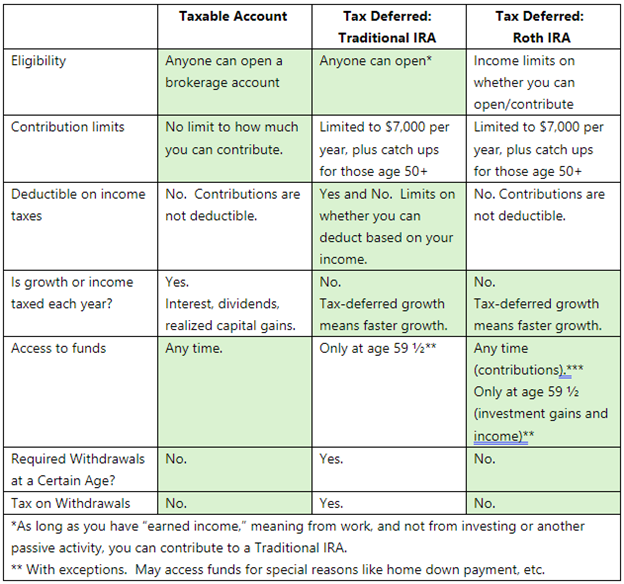

Let’s just boil it down to three accounts: 1) a taxable brokerage account; 2) a Traditional IRA; and 3) a Roth IRA. The thought process is this:

Do you want an account that grows tax deferred (meaning faster)?

Which type of IRA are you eligible for?

How much will you contribute each year?

Do you want access to the funds before age 59 ½?

Do you want a tax deduction for the contributions you make?

Check out the table below to help you think through the type of account that suits you. Of course, consult a tax advisor before making any final decisions.

If you would like to set up an account, here are links to several online brokerages below. Note that I receive no compensation. This is just for your convenience. Choose your broker as you see fit:

Fidelity taxable brokerage: Brokerage account

Fidelity IRA: IRA

Vanguard taxable brokerage: Brokerage account

Vanguard IRA: IRA

Charles Schwab taxable brokerage: Brokerage account

Charles Schwab IRA: IRA

Sources:

* Catherine Harvey, Access to Workplace Retirement Plans by Race and Ethnicity, AARP Public Policy Institute, February 2017, https://www.aarp.org/content/dam/aarp/ppi/2017-01/Retirement%20Access%20Race%20Ethnicity.pdf.coredownload.pdf.

** U.S. Bureau of Labor Statistics.

*** Source: Investment Company Institute for calendar year ending 2022.